Banks are taking ownership of foreclosed homes with increasing regularity in South Jersey, as distressed properties stuck in a years-long pipeline now start to hit the market.

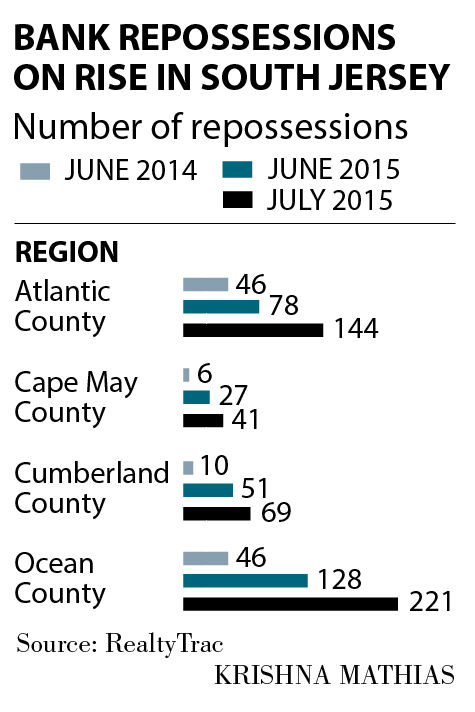

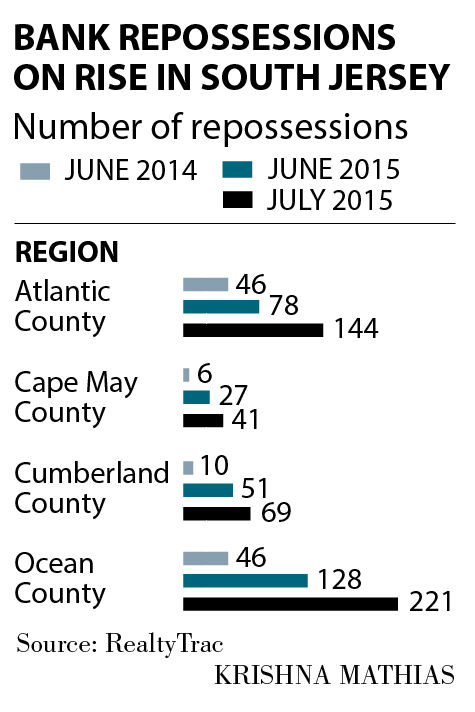

Atlantic, Cape May and Cumberland

counties saw 254 bank repossessions in July, four times more than a

year ago, according to California-based RealtyTrac.

Ocean County had 221 in July, up nearly fivefold from a year ago.

These were homes where the first

written default notices started well before the region’s job struggles

tied to Atlantic City casino closings.

The latest local figures reflect a

national trend of more repossessions mainly because foreclosures in

states such as New Jersey — which requires judicial review and once had a

moratorium — can take years, said Daren Blomquist, vice president of

RealtyTrac.

But another unsettling trend locally is the rise of properties just entering foreclosure with initial default filings.

All four local counties were up, with Atlantic and Cumberland both nearly doubling in July from a year ago.

In contrast, the nation’s rate is at the lowest it has been in a decade, he said.

“When we see a market like

Atlantic County and several other counties in New Jersey, where those

foreclosure starts are also increasing, that’s a bad harbinger of things

to come because that is just properties falling into foreclosure

recently,” he said.

Atlantic County’s default filings

— one of the first steps in the foreclosure process — increased from 85

last July to 146 last month, RealtyTrac said.

Anthony D’Alicandro, owner of

Coldwell Banker Argus Real Estate in Northfield, said more

bank-foreclosed properties have been hitting the market. This is

increasing inventory levels and dropping median sale prices, he said.

And the properties are selling to a combination of homeowners who will live in them and investors paying all cash, he said.

The median sale price for a

single-family home in Atlantic County dropped by $23,900, or about 11

percent, in July from a year ago, according to New Jersey Association of

Realtors data.

D’Alicandro expects to see price declines in the third and fourth quarters because of the bank-owned inventory.

Ultimately, the region’s economy

and job creation will be behind a national comeback, and hopefully it

can come at a time when more properties hit the market, he said.

“The growth in that turnaround is

going to take time till we get to a really substantial increase in job

creation and reduction in the unemployment rate. And hopefully if it

intersects the same time as we get to the end of this backlog of

foreclosures hitting the market. That’s when we’ll see values really

start to turn around,” he said.

Nationally, bank repossessions in

July reached their highest levels since January 2013, and he expects

for them to remain high through the rest of the year.

Locally, some of the sharpest

year-over-year increases were in Cape May and Cumberland counties, which

each had seven-fold increases.

Cape May County had 41 in July, compared to six a year ago. Cumberland County had 69, up from 10 in July 2014.

Contact: 609-272-7253

Twitter @BIanieri

Related post at

Related post at

http://gadfly01.blogspot.com/2015/08/atlantic-county-ranks-highest-in.html

Related post at

Related post athttp://gadfly01.blogspot.com/2015/08/atlantic-county-ranks-highest-in.html

No comments:

Post a Comment