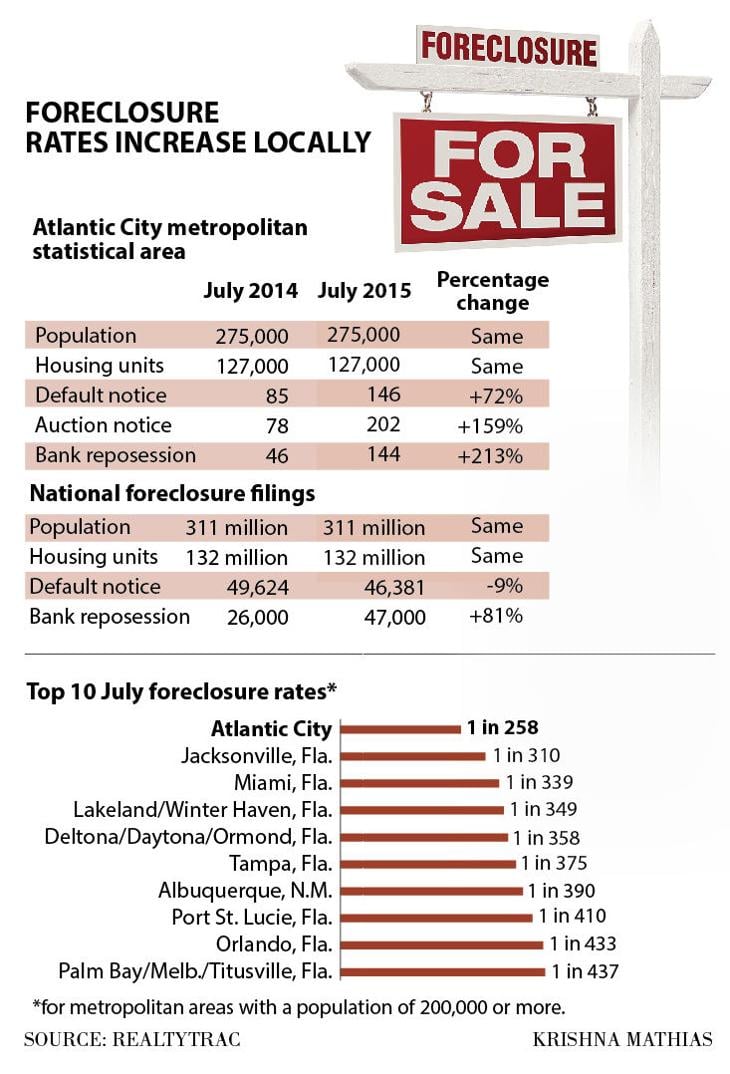

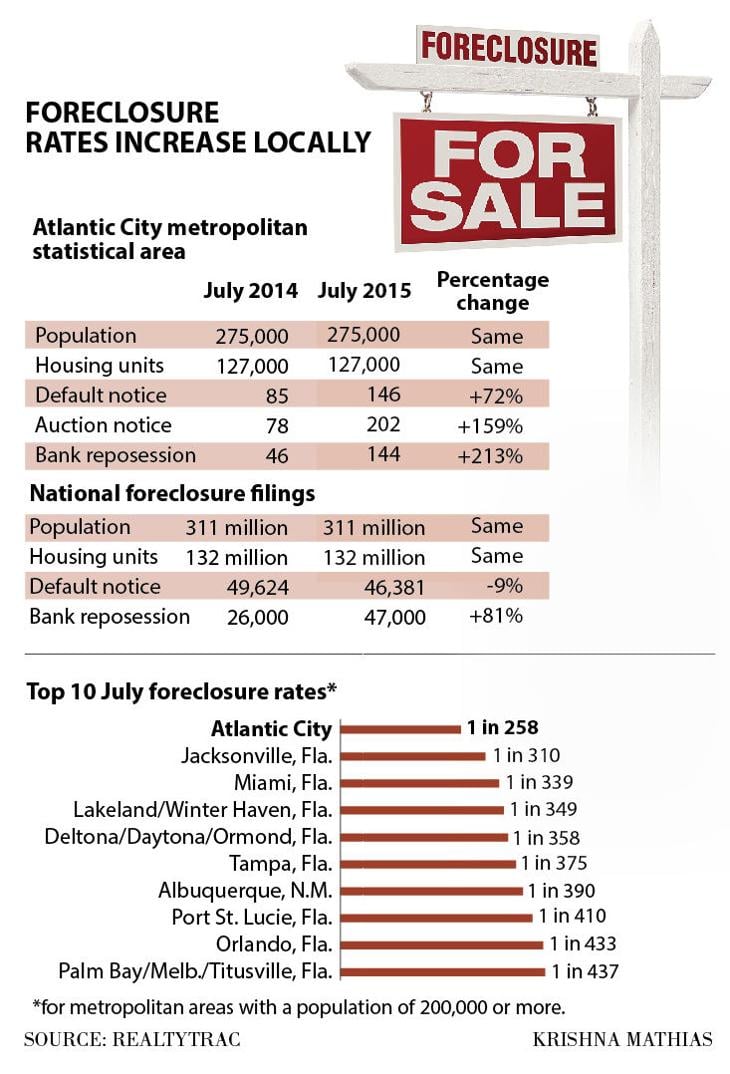

The Atlantic City Metropolitan area continues to lead the nation in foreclosure activity, with a rate four times the national average, according to a July report.

One in every 258 housing units

had a foreclosure filing in July, according to RealtyTrac’s July 2015

U.S. Foreclosure Market Report. That was the worst showing of any

statistical area with a population of 200,000 or more.

Such filings include notices of

default or pending legal action, scheduled auctions and bank

repossessions. The Atlantic City Metropolitan Statistical Area includes

all of Atlantic County.

“In a sense it’s worsening

because the foreclosure numbers are getting higher, but I don’t see a

major shift in trend,” said RealtyTrac Vice President Daren Blomquist.

“In Atlantic City, we are continuing to see activity up across the

board.”

Nationally, new foreclosure

starts are down to their lowest level since 2005, even though overall

foreclosure activity was up 7 percent from the previous month and 14

percent from last July.

http://www.pressofatlanticcity.com/business/atlantic-county-remains-country-s-worst-in-foreclosure-activity/article_c3ed292c-46c1-11e5-9a6f-b74e1b7656f0.html

Mullica Township has 58 houses for sale, 5 Foreclosures, and 75 Pre-Foreclosures according to Zillow.com

http://www.zillow.com/homes/for_sale/Mullica-Township-NJ/398651_rid/39.691469,-74.507389,39.522184,-74.843845_rect/11_zm/1_fr/

But in Atlantic County starts were up almost 72 percent from last July.

“That is indication that Atlantic City is in for a tougher and longer haul back to a healthy housing market,” Blomquist said.

It’s impossible to predict when the market might return to normal in Atlantic County, he said.

“Since you are still ramping up,

we don’t quite know what the peak is,” Blomquist said. “We believe some

of the repossessions are still tied to the last crisis, while starts are

more likely tied to recent economic problems.”

But he said Stockton, California,

and Phoenix, Arizona, were both leading the nation’s foreclosure rates

about five years ago, and the markets have turned around in both of

those places. They now have foreclosure rates lower than the national

average.

“Things can turn around and sometimes pretty quickly,” Blomquist said.

New Jersey’s statewide

foreclosure starts also increased. They are up 129 percent over last

July. Blomquist said some of the starts may involve properties that

entered the foreclosure process years ago, then fell out of it. They are

counted again as starts if it has been at least three years since the

last default notice, he said.

New Jersey posted the third-highest overall foreclosure rate for states, behind just Florida and Maryland.

More activity in auction notices

and bank repossessions across the country meant July was the fifth

consecutive month with a year-over-year increase in overall foreclosure

activity. That followed 53 consecutive months of decreases, according to

RealtyTrac.

Nationwide a total of 124,910 U.S. properties experienced foreclosure filings in July.

For the full report visit: realtytrac.com/news/foreclosure-trends/realtytrac-july-2015-u-s-foreclosure-market-report/.

Contact: 609-272-7219

Twitter @MichelleBPost

http://www.pressofatlanticcity.com/business/atlantic-county-remains-country-s-worst-in-foreclosure-activity/article_c3ed292c-46c1-11e5-9a6f-b74e1b7656f0.html

Mullica Township has 58 houses for sale, 5 Foreclosures, and 75 Pre-Foreclosures according to Zillow.com

http://www.zillow.com/homes/for_sale/Mullica-Township-NJ/398651_rid/39.691469,-74.507389,39.522184,-74.843845_rect/11_zm/1_fr/

No comments:

Post a Comment