Excerpts from long article at

http://www.pressofatlanticcity.com/business/tax-plan-would-stabilize-a-c-casino-values-raise-county/article_f240d326-858f-11e4-a672-6bff965bf404.html

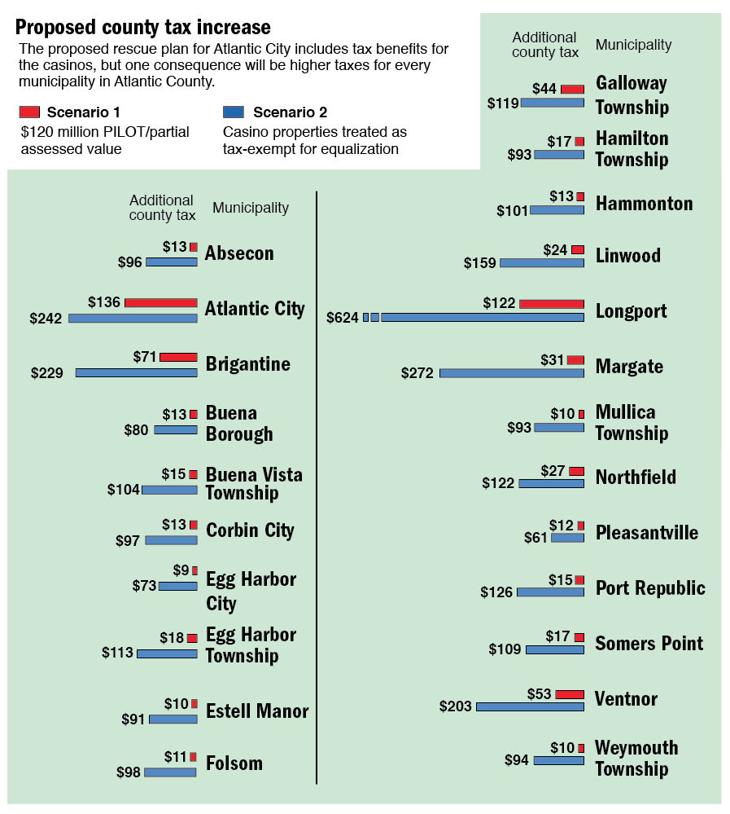

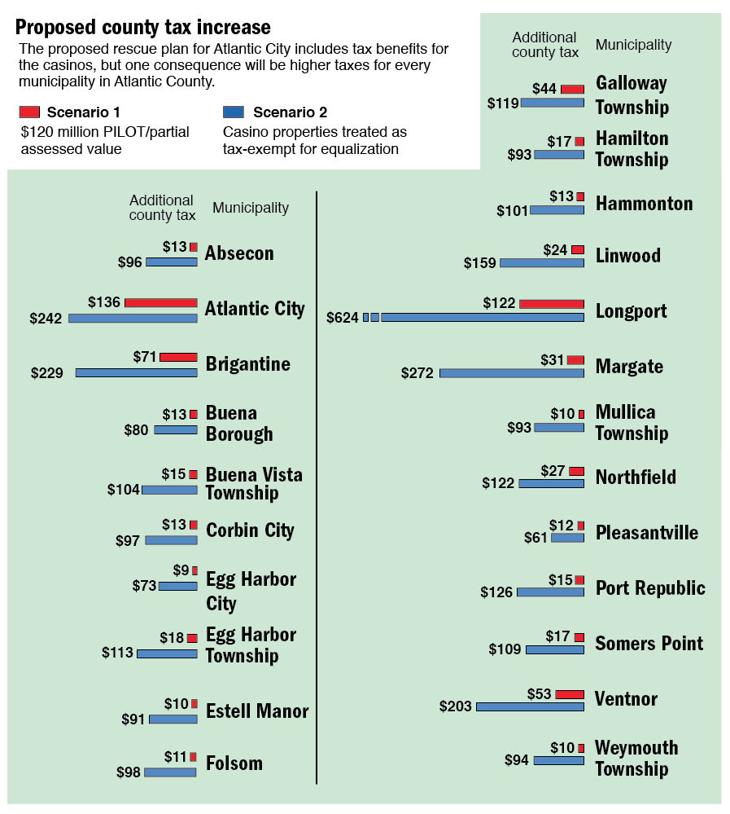

Property owners in

all 23 Atlantic County municipalities would pay higher county taxes

under a proposed recovery plan for Atlantic City that gives casinos

millions of dollars in tax relief.

http://www.pressofatlanticcity.com/business/tax-plan-would-stabilize-a-c-casino-values-raise-county/article_f240d326-858f-11e4-a672-6bff965bf404.html

Some elected officials denounced

the plan as “preposterous” and a “casino bailout” that will harm

ordinary taxpayers, including those in Atlantic City who are supposed to

benefit from the legislation.

“It’s preposterous that the

county taxpayer will have to pay more because of the deal the casinos

are given,” Atlantic County Executive Dennis Levinson said.

Levinson stated the county is

powerless to stop the higher tax rates if the Legislature approves the

Atlantic City recovery plan. He said no state lawmakers consulted him

beforehand about the tax implications.

The PILOT program, for tax

purposes, would reduce the amount of county taxes paid by Atlantic City. The rest of the Atlantic County municipalities would

have to pick up the slack. The most likely scenario is that the county

tax rate would increase by just a few cents, meaning most homeowners

would see modestly higher tax bills. The range would be less than $10

per year for average homeowners in towns such as Egg Harbor City, Estell

Manor, Mullica Township and Weymouth Township to about $121 for

Longport.

Things

could change dramatically if the casinos were treated as totally

tax-exempt properties instead of having to make the PILOT payments.

Under that scenario, Atlantic City’s assessed value would drop by $6.275

billion, forcing property owners in other Atlantic County

municipalities to pay even more for the county tax rate.

Mullica taxpayers would pay an increase in county tax of approximately $93 a year.

Assemblyman Chris Brown's plan - freeze taxes +

Assemblyman Chris Brown announced a plan to help Atlantic City recover while providing tax relief for all Atlantic County taxpayers at a press conference Wednesday, Dec. 17 at the Egg Harbor Township Community Center.

http://www.nbc40.net/story/27653650/assemblyman-brown-calls-for-5-year-property-tax-freeze-in-ac

Recovery vote delay - Taj Mahal dispute ongoing

http://www.pressofatlanticcity.com/business/taj-mahal-dispute-delays-vote-on-atlantic-city-recovery-plan/article_eeda7128-86f3-11e4-869e-b3221dab90b3.html

Local concerns

http://gadfly01.blogspot.com/2015/01/atlantic-city-tax-plan-causes-local.html

State Plan

Mullica taxpayers would pay an increase in county tax of approximately $93 a year.

Assemblyman Chris Brown's plan - freeze taxes +

Assemblyman Chris Brown announced a plan to help Atlantic City recover while providing tax relief for all Atlantic County taxpayers at a press conference Wednesday, Dec. 17 at the Egg Harbor Township Community Center.

http://www.nbc40.net/story/27653650/assemblyman-brown-calls-for-5-year-property-tax-freeze-in-ac

Recovery vote delay - Taj Mahal dispute ongoing

http://www.pressofatlanticcity.com/business/taj-mahal-dispute-delays-vote-on-atlantic-city-recovery-plan/article_eeda7128-86f3-11e4-869e-b3221dab90b3.html

Local concerns

http://gadfly01.blogspot.com/2015/01/atlantic-city-tax-plan-causes-local.html

State Plan

2 comments:

The county taxes have gone up every single year for the past 5 years. Look at your tax bills. Now in addition to these massive tax county tax increases, you are telling me that the state can devalue the casinos and stick another huge additional burden on the remaining property owners in Atlantic County?

The residents in every Atlantic County community will revolt when they are losing their jobs and being taxed out of their homes. Poor leadership.

Senator Whelan (a resident himself of AC) wrote this thing with Vince Mazzeo w/o consulting Chris Brown.

Not only is Whelan hitting all of us , he's also giving Guardian a break in A.C. by diverting some of the funding for other things like CRDA in this bill back to the government who will also blow this w/o any cuts in their high living.

Since casino revenue benefits the entire state why is only Atlantic County taking this hit?

I'd much rather see Chris Browns proposal of a 5 year tax freeze for A.C. that forces Guardian to make the cuts and/ or declare bankruptcy but he hasn't the nerve to do on his own.

I doubt it will happen however.

By the way, Whelan brazzenly and openly states time and time again that we(residents of Atlantic County}

have had it easy all these years of living off the casino taxes and it's time we do our fair share. Why does this tax and spend guy keep getting re elected?

Post a Comment